|

|

| Rating: 4 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Early Warning Services, LLC |

| Zelle App: Simplified Money Transfers Made Easy | zelle | fast | send |

The Zelle App is a popular peer-to-peer payment service that enables users to send and receive money securely and conveniently. With over hundreds of participating banks and credit unions in the United States, Zelle provides a seamless platform for individuals to transfer funds directly from their bank accounts using their mobile devices. By leveraging the existing infrastructure of financial institutions, Zelle offers a trusted and efficient way to make payments, split expenses, and send money to friends, family, or acquaintances.

Zelle’s user-friendly interface and wide network of participating banks make it a convenient choice for users looking for a simple and direct payment solution. Unlike traditional payment methods, such as checks or cash, Zelle enables instant transfers, eliminating the need for physical exchange and offering a faster and more efficient way to handle financial transactions. With its widespread adoption and focus on security and convenience, Zelle has become a preferred option for many individuals seeking a reliable peer-to-peer payment service.

Features & Benefits

- Fast and Convenient Money Transfers: Zelle enables users to send and receive money quickly and conveniently. The app allows seamless transfers between bank accounts, eliminating the need for physical cash or checks.

- Wide Bank Network: Zelle has partnered with numerous banks and financial institutions, making it accessible to a large user base. Users can connect their bank accounts directly to the app, simplifying the transfer process.

- Real-Time Transactions: Zelle facilitates real-time transactions, ensuring that money is transferred instantly between users. This feature is particularly useful for urgent payments or when time is of the essence.

- Secure and Encrypted: Zelle prioritizes security and uses advanced encryption technology to protect users’ financial information. The app’s robust security measures provide peace of mind when sending and receiving money.

- Splitting Bills Made Easy: Zelle allows users to split bills with friends and family effortlessly. Users can divide expenses and request payments directly through the app, streamlining the process of settling shared costs.

Pros & Cons

- Instant money transfers directly into recipients’ bank accounts

- Wide integration with major banks, providing easy access for users

- Simple and intuitive user interface for quick and hassle-free transactions

- No additional fees for sending or receiving money

- Strong security measures to protect user information and transactions

- Limited to users within the United States, excluding international transfers

- Availability depends on the user’s bank’s participation in the Zelle network

- Lack of customer support options directly within the app

- Some users may experience delays if their bank does not offer real-time processing

- Dependency on internet connectivity for app functionality

Similar Apps

Apple Pay: Apple Pay allows iPhone and Apple Watch users to make secure payments using their devices. It supports in-store, online, and peer-to-peer transactions, and offers a seamless and convenient payment experience.

Square Cash: Square Cash, developed by Square, enables users to send and receive money quickly. It offers a simple interface and the ability to create a unique username, known as a $Cashtag, for easy identification.

Facebook Pay: Facebook Pay, integrated within the Facebook app, allows users to send money to friends, make donations, and even make purchases through Facebook Marketplace. It offers a social platform for financial transactions.

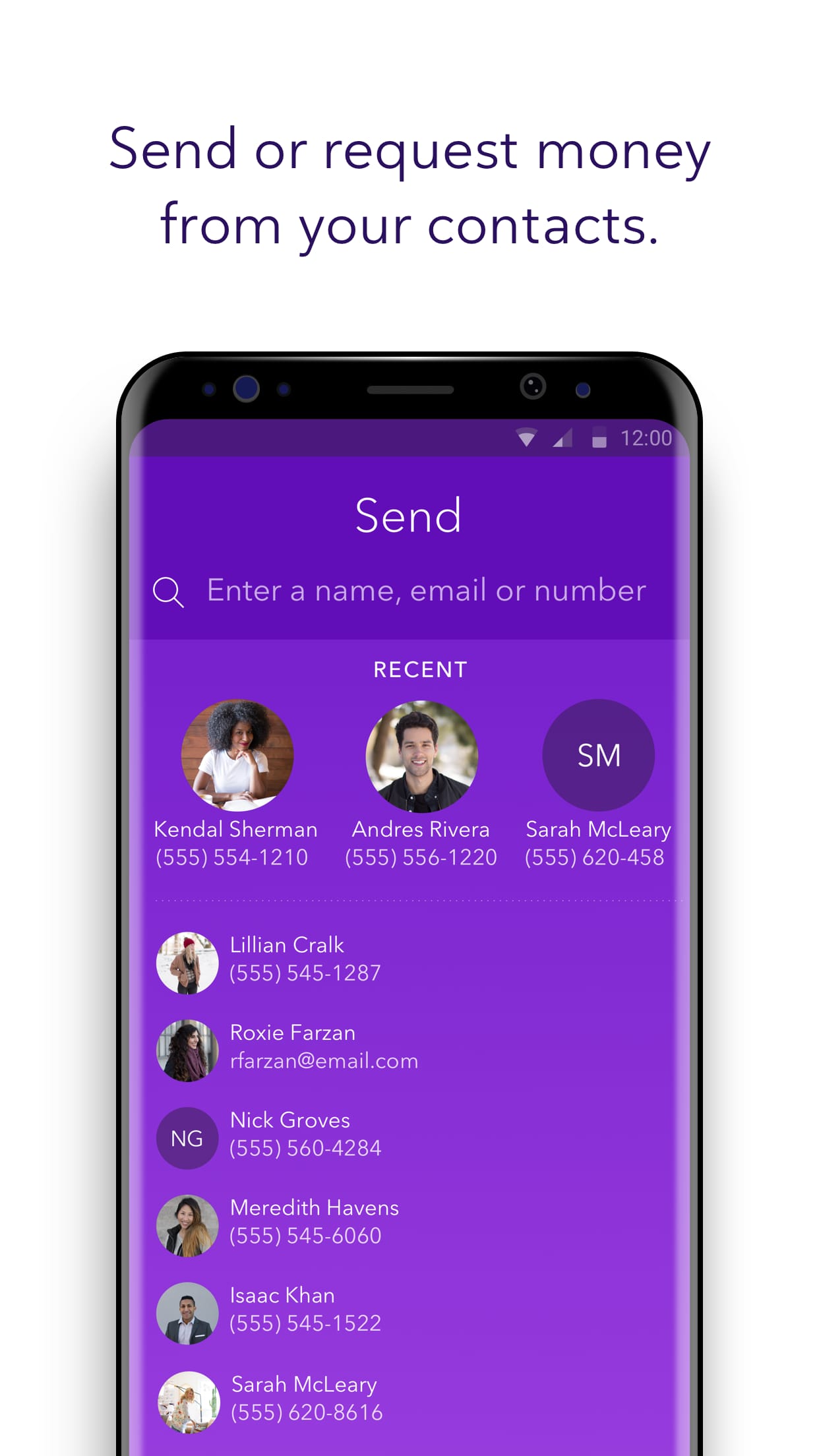

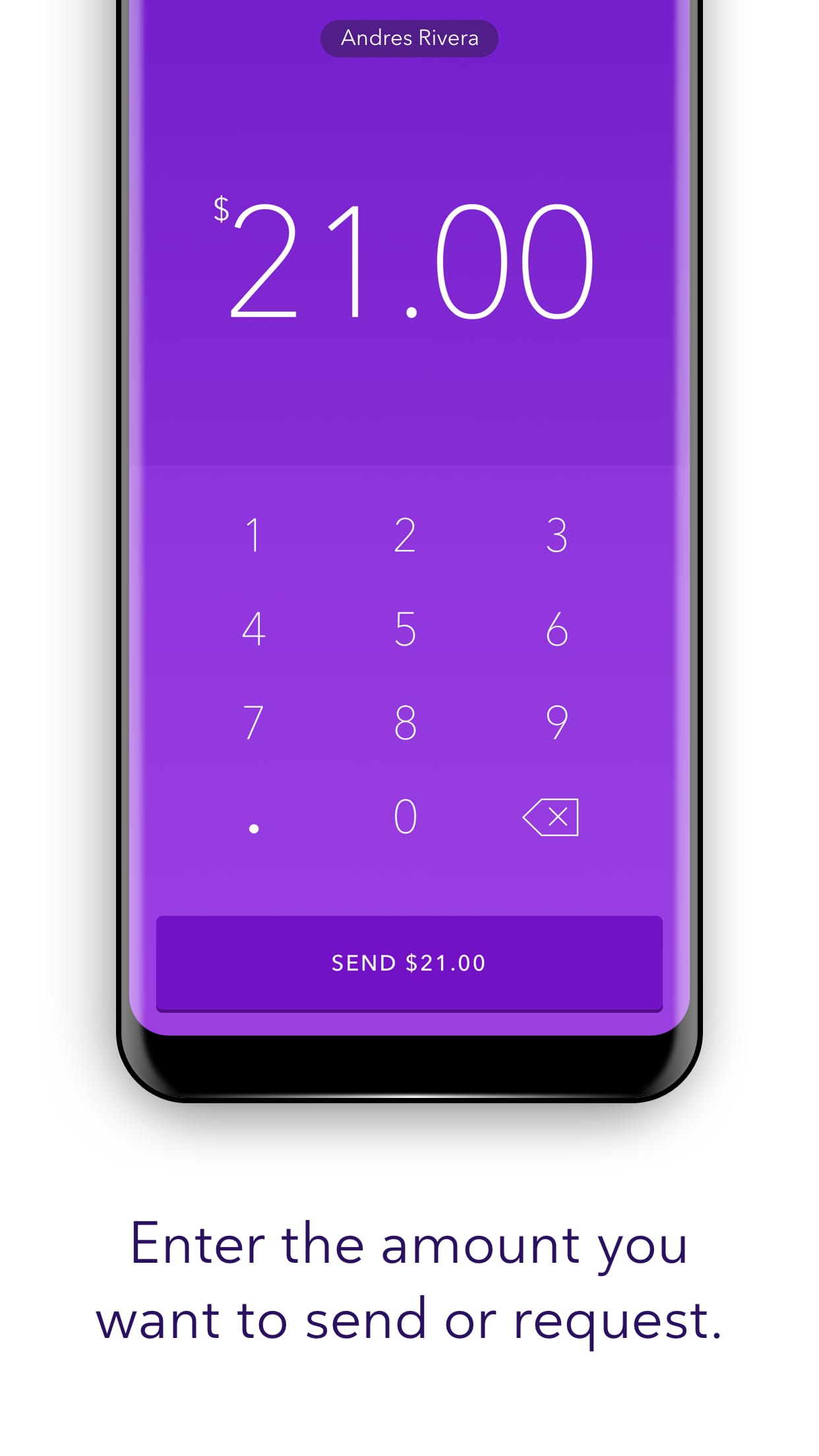

Screenshots

|

|

|

|

In conclusion, the Zelle App offers a convenient and secure platform for peer-to-peer payments. With its direct bank integration, wide network of participating banks, and near-instant transfers, Zelle simplifies the process of sending and receiving money. The app’s emphasis on security and its integration with existing financial institutions provide users with peace of mind when conducting transactions.

While Zelle has limitations such as its limited international availability and dependence on bank participation, its benefits, including simplified expense splitting and enhanced security features, make it a popular choice among users. With positive user reviews highlighting its convenience and speed, Zelle continues to be a preferred option for individuals seeking a seamless and reliable peer-to-peer payment service.

Faqs

What banks work with Zelle?

Zelle is integrated with over 1,000 banks and credit unions in the United States.

Can I use Zelle to make payments to businesses?

No, Zelle is designed strictly for person-to-person payments, not for commercial transactions.

How secure is the Zelle app?

Zelle employs advanced encryption and authentication to protect user data and payments.

How long does it take for Zelle payments to be processed?

Zelle payments are usually delivered within minutes when sent to an enrolled recipient.

Can I use Zelle internationally?

No, Zelle is currently only available for domestic payments within the United States.