|

|

| Rating: 4.4 | Downloads: 10,000,000+ |

| Category: Finance | Offer by: Intuit Inc |

| TurboTax App: Simplifying Tax Filing | turbotax | finance | social |

Tax season can be a daunting time for many individuals and businesses. However, with the TurboTax app, tax filing becomes a breeze. TurboTax is a popular tax preparation software that offers a range of features to simplify the process of filing taxes. Whether you’re a freelancer, a small business owner, or an individual taxpayer, the TurboTax app provides a user-friendly platform to navigate the complexities of tax preparation and maximize your deductions.

With TurboTax, you can say goodbye to the days of struggling through confusing tax forms and calculations. The app guides you step-by-step through the tax filing process, ensuring accuracy and efficiency. From importing your financial information to providing personalized tax-saving tips, TurboTax empowers you to take control of your taxes and achieve the best possible outcome.

Features & Benefits

- Easy-to-Use Interface: TurboTax features a user-friendly interface that makes tax preparation accessible to everyone. The app provides clear instructions and prompts, guiding you through each section and ensuring that you don’t miss any crucial information. Whether you’re a tax expert or a first-time filer, TurboTax’s intuitive interface simplifies the process and reduces the stress associated with tax preparation.

- Step-by-Step Guidance: TurboTax offers step-by-step guidance to help you navigate through various tax forms and calculations. The app asks you simple questions about your financial situation and automatically populates the appropriate forms based on your answers. This feature ensures that you provide accurate information and helps you maximize your deductions, potentially saving you money.

- Importing Financial Data: TurboTax allows you to import your financial data directly from your bank accounts, investment platforms, and employers. This eliminates the need for manual data entry and minimizes the chances of errors. Whether it’s your W-2 form, investment statements, or mortgage interest information, TurboTax can securely retrieve and organize your financial data, saving you time and effort.

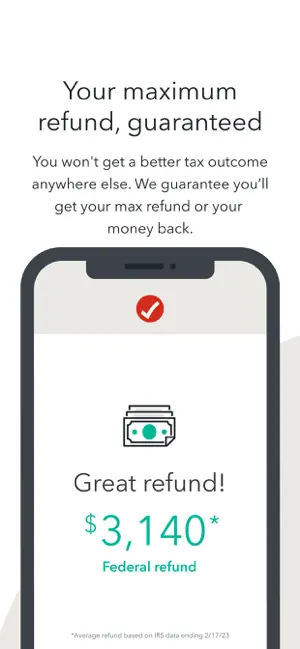

- Deduction and Credit Maximization: TurboTax’s robust algorithms scan your tax return for potential deductions and credits that you may be eligible for. The app searches for commonly overlooked deductions and ensures that you claim all the credits you qualify for. By maximizing your deductions and credits, TurboTax helps you reduce your tax liability and potentially increase your tax refund.

- Expert Support and Review: TurboTax provides access to expert support throughout the tax preparation process. If you have questions or need clarification at any point, you can rely on TurboTax’s knowledgeable support team to provide assistance. Additionally, the app offers a final review of your tax return before filing, ensuring that your return is error-free and optimized for the best possible outcome.

Pros & Cons

- User-friendly interface with step-by-step guidance for easy tax preparation.

- Smart importing of tax documents to save time and minimize errors.

- Deduction Finder feature to maximize deductions and credits.

- Access to tax experts for personalized assistance.

- Convenient and secure filing from any location.

- Some advanced tax situations may require additional forms or manual entry.

- Certain features may be limited to higher-tier pricing plans.

- The app’s user interface can feel overwhelming for first-time users.

- Occasional glitches or technical issues may disrupt the filing process.

- The cost of premium features or additional services can add up for some users.

Similar Apps

Credit Karma Tax: Credit Karma Tax is a free tax preparation app that offers simple and straightforward tax filing. It provides guidance and supports various tax forms and schedules.

TaxJar: TaxJar is an app designed for e-commerce sellers to automate their sales tax calculations and filings. It integrates with various e-commerce platforms and simplifies sales tax compliance.

FreeTaxUSA: FreeTaxUSA is a tax preparation app that offers free federal tax filing and affordable state tax filing. It provides step-by-step guidance, supports various tax scenarios, and offers accuracy guarantees.

Screenshots

|

|

|

|

In conclusion, the TurboTax App offers a range of features and benefits that simplify the tax preparation process for individuals and small businesses. With its user-friendly interface, smart importing capabilities, and deduction maximization tools, TurboTax helps users navigate through complex tax forms with ease. The access to tax experts and the convenience of filing from anywhere add to its appeal. While there may be occasional glitches and the cost can add up for premium features, TurboTax remains a trusted and efficient tax preparation app for many users. Whether you’re a seasoned taxpayer or a first-time filer, TurboTax can help you file your taxes accurately and with confidence.

Faqs

Can I use the TurboTax app to file past year tax returns?

Yes, the TurboTax app allows users to file tax returns for multiple past years, making it a convenient option for those who need to catch up on their tax filings.

How secure is the TurboTax app?

TurboTax takes security seriously, using encryption and other measures to protect user data and ensure the confidentiality of sensitive tax information.

Does the TurboTax app offer any tax planning tools?

In addition to tax preparation, the TurboTax app provides tax planning tools and year-round advice to help users optimize their tax situation.

Can I use the TurboTax app to file business or self-employment taxes?

Yes, the TurboTax app offers specialized versions and features for self-employed individuals and small business owners to file their taxes.

Can I use the TurboTax app to file taxes for multiple years at once?

Yes, the TurboTax app allows users to file tax returns for multiple years, making it easier to catch up on past tax filings.