|

|

| Rating: 4.2 | Downloads: 50,000,000+ |

| Category: Finance | Offer by: PayPal, Inc. |

| Venmo App: Seamlessly Transfer Funds and Split Expenses | venmo | pay | paid |

The Venmo App is a popular mobile payment service that revolutionizes the way people send and receive money. Developed by PayPal, Venmo provides a convenient and secure platform for individuals to split bills, pay friends or family, and make purchases seamlessly from their smartphones. With its user-friendly interface and social media-like features, Venmo has gained widespread popularity, especially among younger generations, as a go-to app for peer-to-peer transactions and splitting expenses.

Venmo simplifies the process of sending and requesting money, eliminating the need for cash or checks. Users can link their bank accounts, debit cards, or credit cards to the app, making transactions quick and hassle-free. Additionally, Venmo’s social feed enables users to share payment activity, adding a social element to the app and making it a popular choice for splitting expenses among friends or roommates. With its convenience, ease of use, and social features, Venmo has become a prominent player in the digital payment landscape.

Features & Benefits

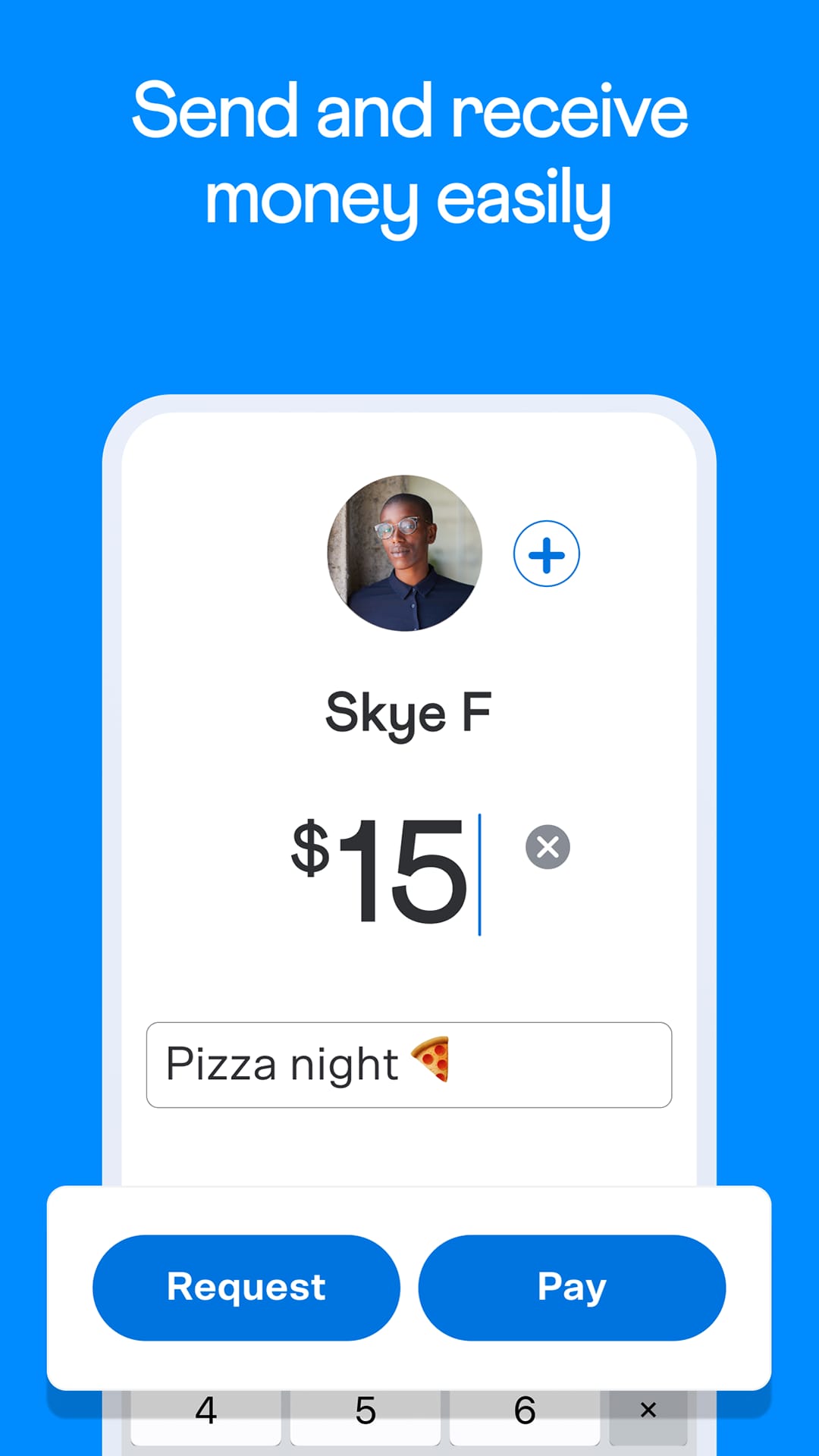

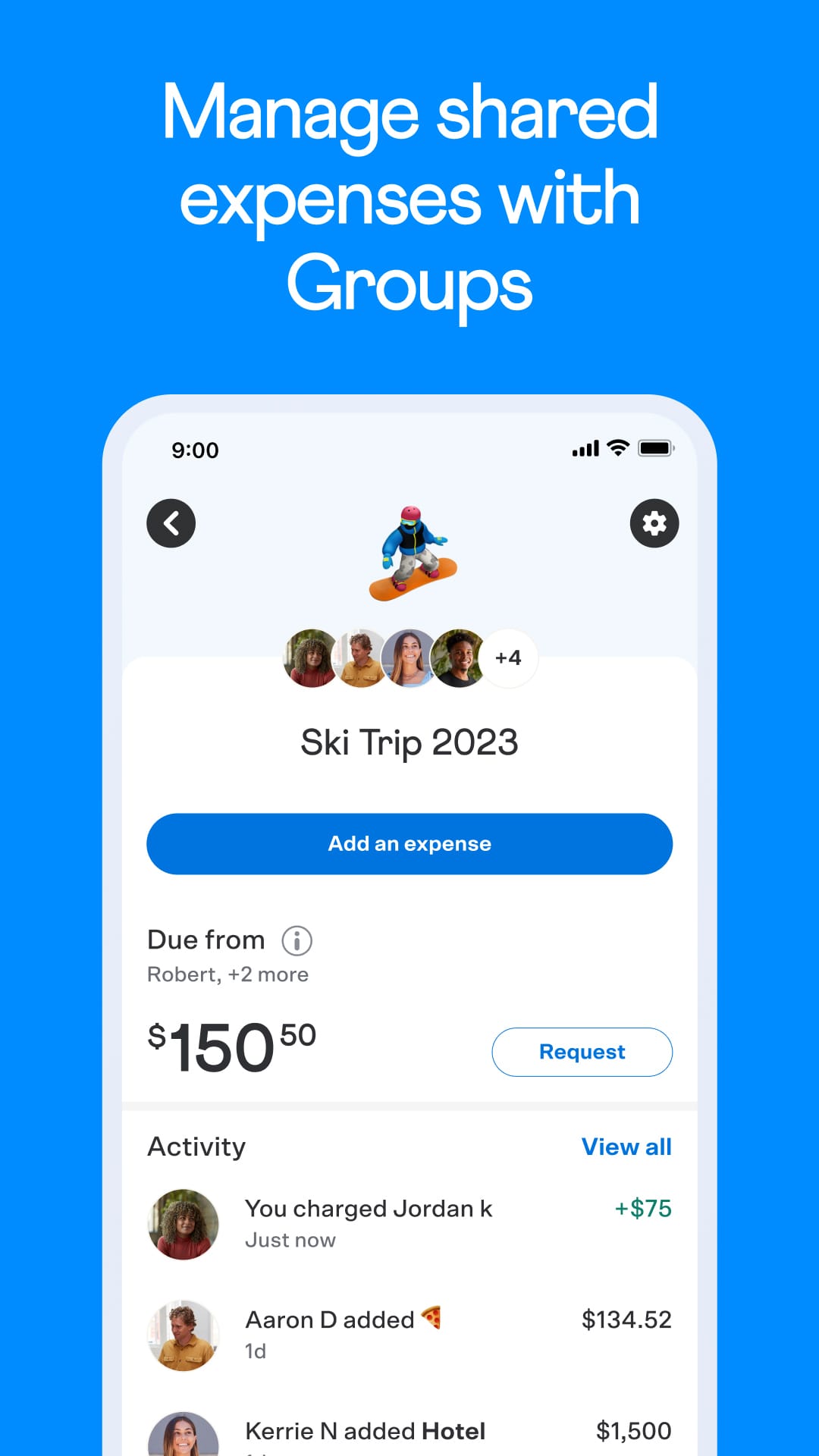

- Easy Peer-to-Peer Payments: Venmo allows users to send and receive money easily among friends, family, and acquaintances. It simplifies the process of splitting bills, paying back loans, or sharing expenses, eliminating the need for cash or checks.

- Social Payment Experience: The app incorporates a social aspect by enabling users to view and engage with their friends’ payment activities. It adds a fun and interactive element to transactions, making it feel more like a social network while maintaining privacy controls.

- Convenient Payment Options: Venmo offers multiple payment options, including bank transfers, debit card payments, and the ability to link credit cards. This flexibility allows users to choose the payment method that suits them best, making transactions seamless.

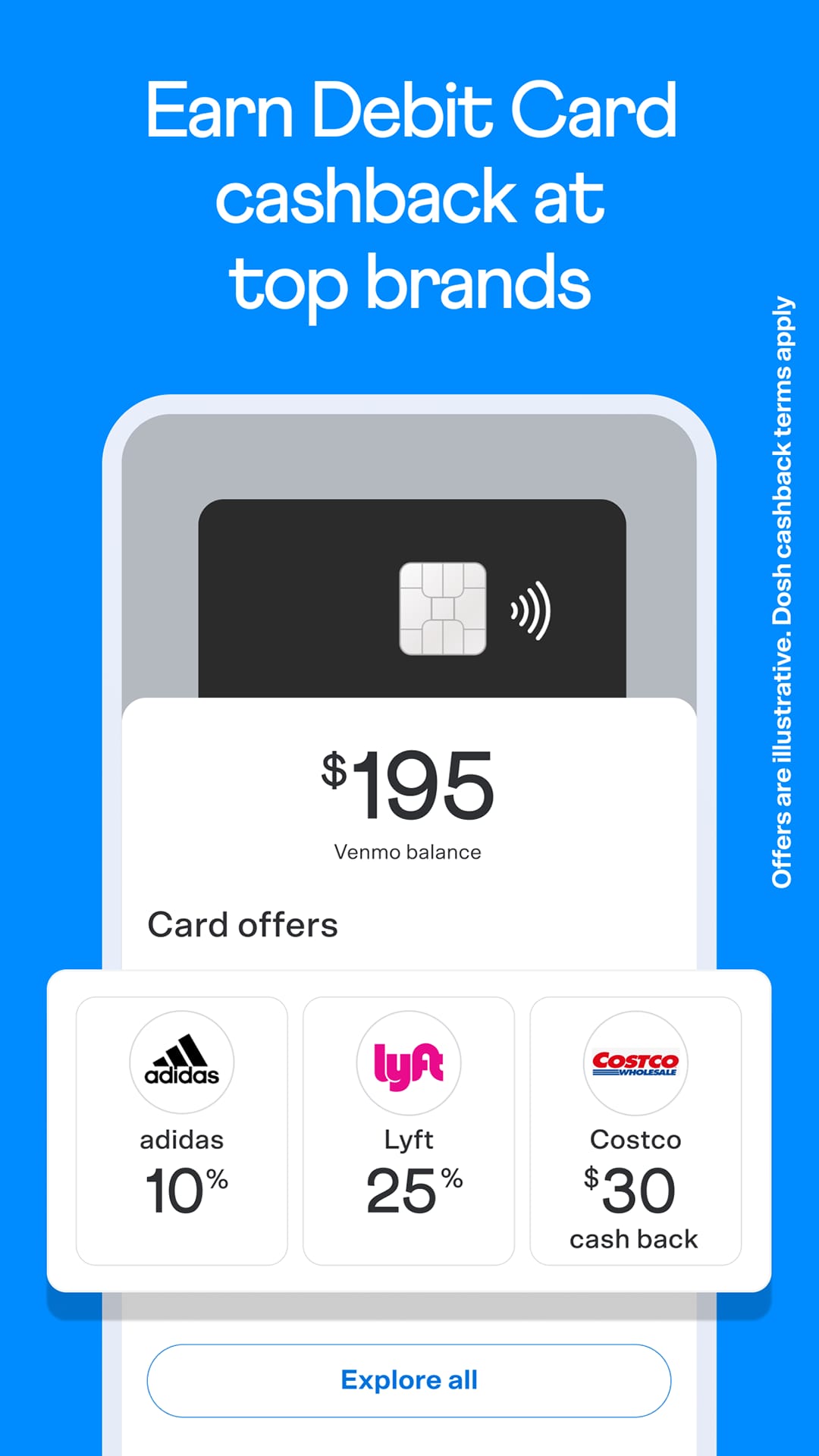

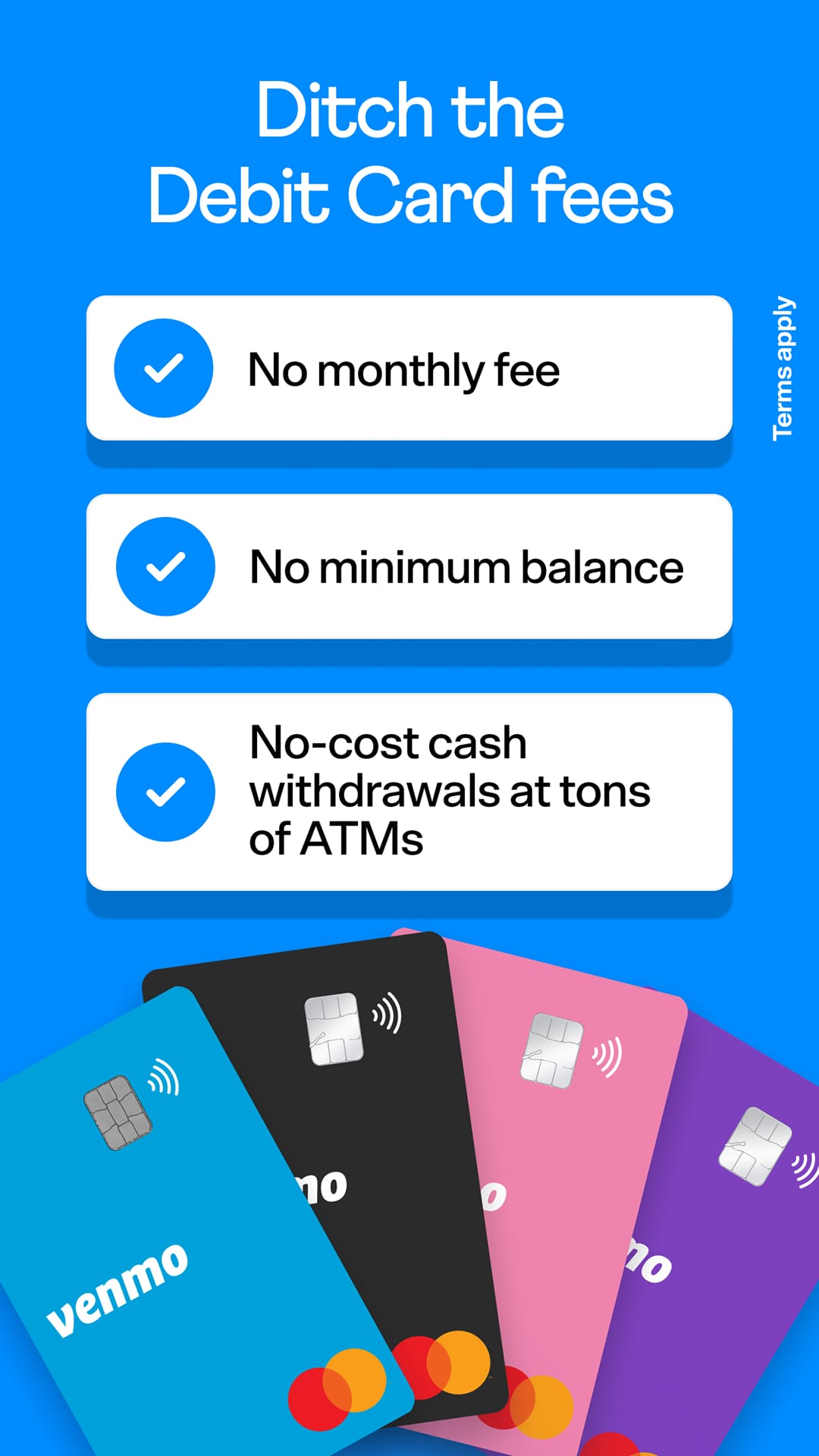

- Venmo Card: Users can request a physical Venmo debit card, which is connected to their Venmo account. This card can be used for purchases at any merchant that accepts Mastercard, providing a convenient way to access funds and make payments.

- Integration with Merchants: Venmo has integrated with various merchants, allowing users to make purchases directly through the app. This feature eliminates the need to enter payment information repeatedly, making online shopping more convenient.

Pros & Cons

- Easy and convenient fund transfers among friends and family

- Simplified process for splitting expenses and settling bills

- Social interactions and engagement through likes and comments

- Venmo debit card for convenient purchases with Venmo balance

- Strong security measures and user privacy controls

- Limited international functionality, primarily focused on the United States

- Transaction fees for certain types of payments, such as credit card transactions

- Public nature of payment activity, which may be a concern for those seeking more privacy

- Limited customer support options, primarily relying on self-service resources

- Dependency on internet connectivity for app functionality

Similar Apps

Apple Pay: Apple Pay is a mobile payment and digital wallet service by Apple. It allows users to make payments using their Apple devices at participating merchants, both online and in physical stores.

Facebook Pay: Facebook Pay is a payment feature integrated into Facebook’s family of apps, including Facebook Messenger, WhatsApp, and Instagram. It enables users to send money, make purchases, and donate to fundraisers.

Square Cash: Square Cash, developed by Square, offers a simple and straightforward way to send money to friends and family. It also provides a Cash Card for making purchases and withdrawing funds.

Screenshots

|

|

|

|

In conclusion, the Venmo App has revolutionized the way people transfer money and split expenses. With its easy-to-use interface, social payment feed, and seamless integration with bank accounts, Venmo offers a convenient and efficient platform for peer-to-peer transactions. It simplifies the process of splitting bills among friends and provides a secure environment with buyer protection. However, it’s important to consider the app’s limitations, such as its limited international availability and transaction fees. Nonetheless, Venmo has garnered positive reviews from users who appreciate its convenience, social features, and enhanced payment experience. Whether you’re settling payments with friends, splitting expenses, or making purchases, Venmo remains a popular choice for mobile payments.

Faqs

What payment methods does Venmo support?

Venmo integrates with bank accounts, debit cards, credit cards, and even digital wallets.

Is my Venmo account and payment information secure?

Venmo employs industry-standard security measures to protect user data and transactions.

Can I link my Venmo account to social media?

Yes, Venmo has a social feed feature that allows users to share and view payment activities.

How long does it take for Venmo payments to be processed?

Standard payments typically take 1-3 business days to clear, with instant transfers available.

Does Venmo charge any fees for using the service?

Venmo generally doesn’t charge fees for most basic payment transactions.